Provision in Bylaws: The Bylaws of the Company establish the distribution of a minimum dividend that is the higher of R$359 million or 25% of net income from the year (IFRS).

Dividend practice: ISA ENERGIA BRASIL’s dividend practice is to distribute at least 75% of regulatory net income (used as proxy for cash generation), subject to approval by the Shareholders Meeting, and the possibility of paying interim dividends, always ensuring that the dividend will be equal to or higher than minimum mandatory dividends.

Announcement of Dividend Distribution:

On December 19, 2025, the Board of Directors of ISA ENERGIA BRASIL approved the accrual and payment to shareholders of Interest on Equity (“JCP”) in the total amount of BRL 495,255,565.40 (four hundred ninety-five million, two hundred fifty-five thousand, five hundred sixty-five reais and forty cents), corresponding to BRL 0.751659 per share of both classes, subject to withholding of Income Tax at the rate of 15% (fifteen percent), except for shareholders who are duly exempt or immune, or shareholders domiciled in countries where legislation establishes different rates. The JCP will be credited in three payments, as per the following information:

| Earning Type | Deliberation Date | Distribution Base | Record Date | Ex-right Date | Payment Date | Total (R$ million) | Gross R$ / share | Net R$ / share |

|---|---|---|---|---|---|---|---|---|

| Interest on Equity ("IOE") | 19-Dec-25 | Result of the fiscal year 2025 | 29-Dec-25 | 30-Dec-25 | 28-Jan-26 | 165.09 | 0.2505 | 0.2130 |

| 29-Jan-26 | 30-Jan-26 | 25-Feb-26 | 165.09 | 0.2505 | 0.2130 | |||

| 26-Feb-26 | 27-Feb-26 | 31-Mar-26 | 165.09 | 0.2505 | 0.2130 | |||

| Total | 495.26 | 0.7515 | 0.6389 | |||||

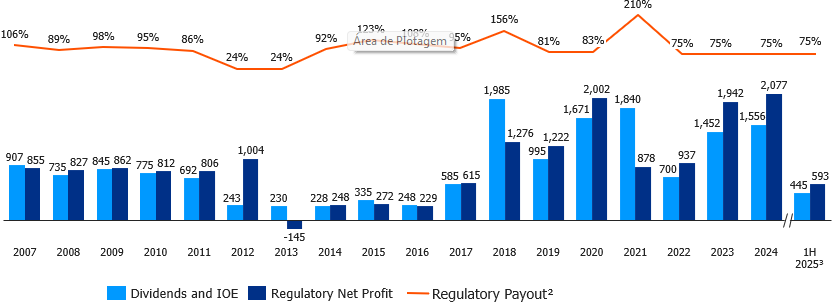

Historic of Earnings Distribution1 (R$ million)

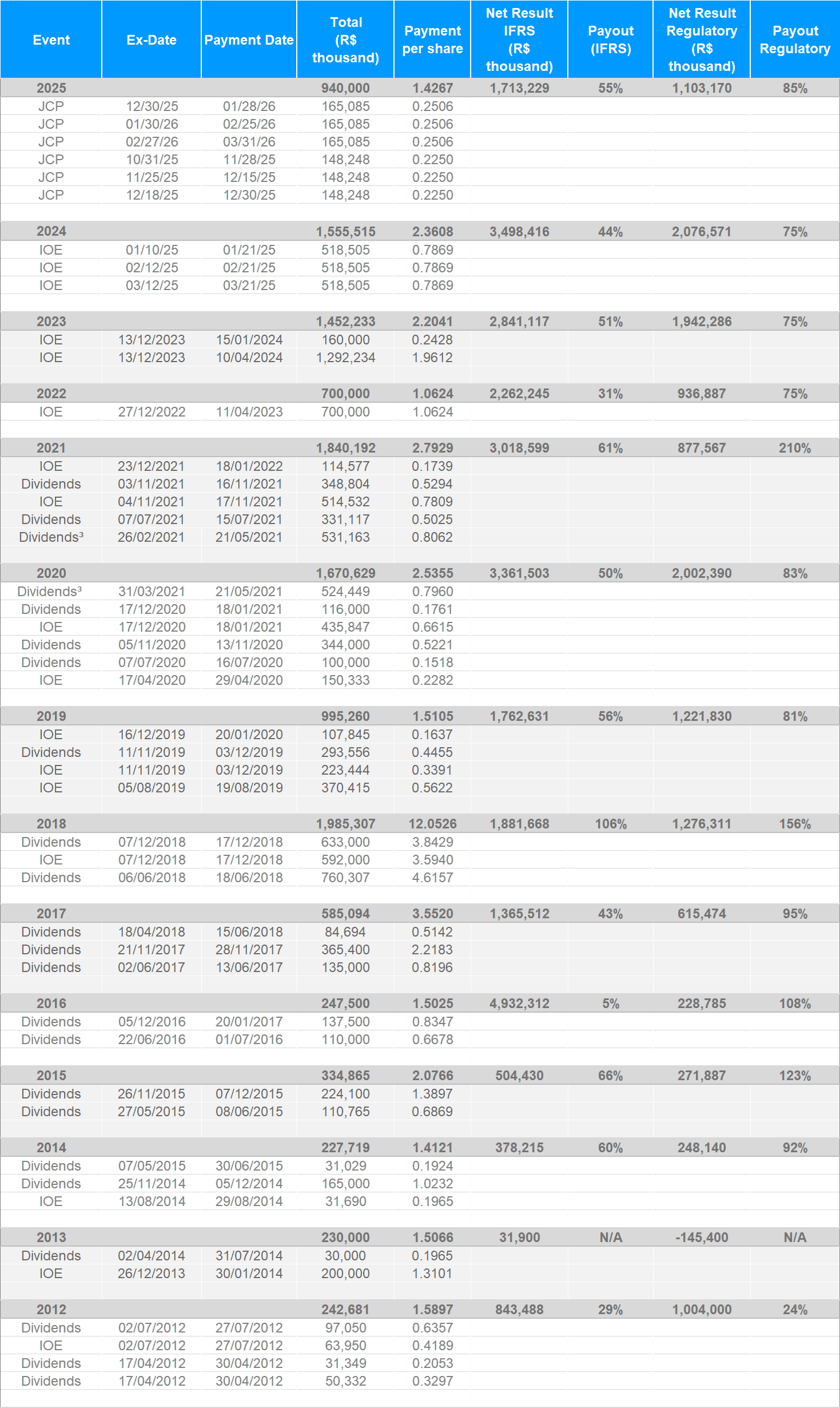

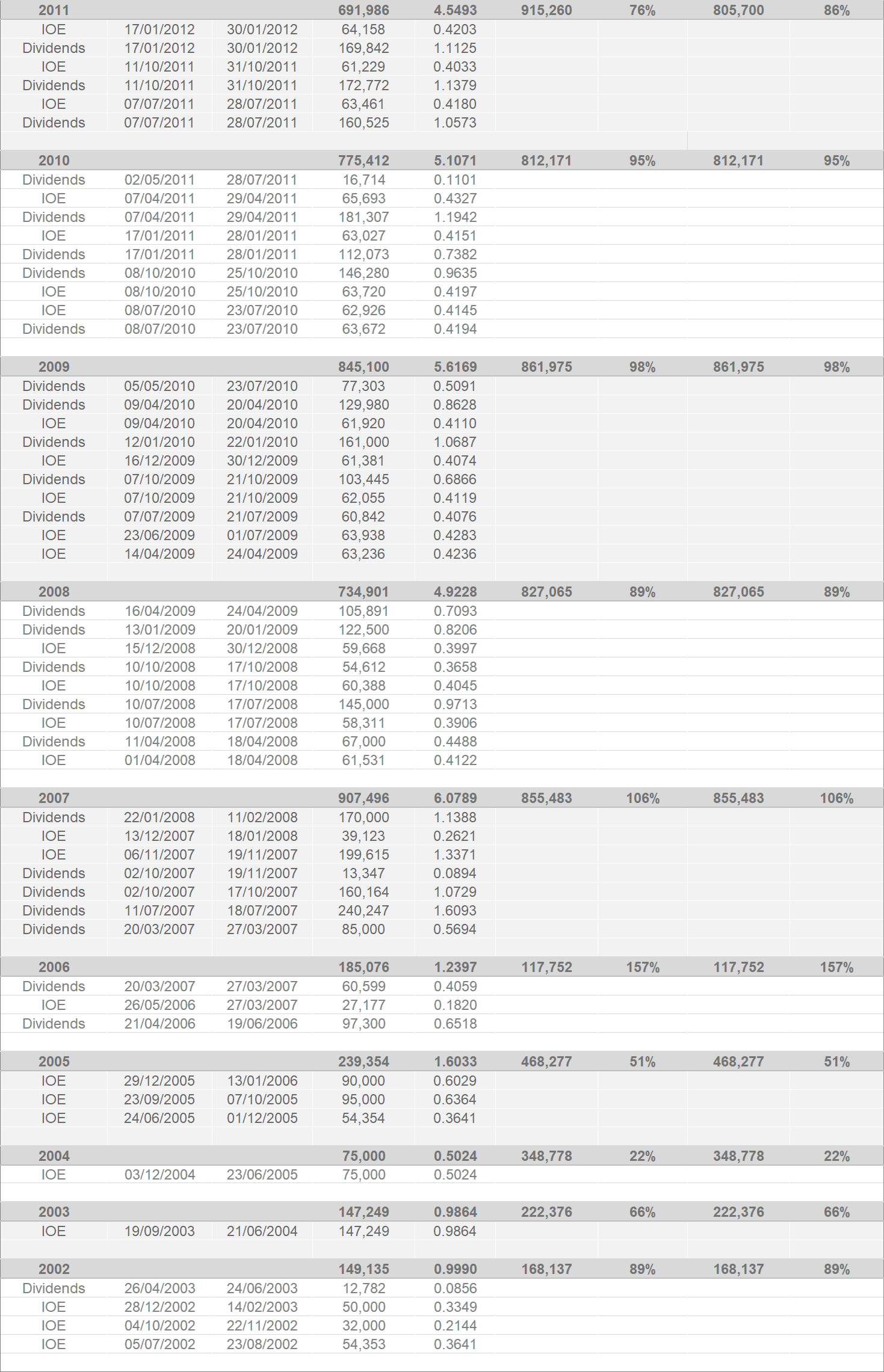

Annual Summary of Earnings Distribution (R$ million)

| Payment Year | IOE (R$ thousand) |

Dividends (R$ thousand) |

Total (R$ thousand) |

Payment per share |

Dividends per share |

|---|---|---|---|---|---|

| 2024 | 1.452.233 | - | 1.452.233 | R$ 2,20408 | R$ - |

| 2023 | 700.000 | - | 700.000 | R$ 1,06240 | R$ - |

| 2022 | 114.577 | - | 114.577 | R$ 0,17390 | R$ - |

| 2021 | 950.379 | 1.851.532 | 2.801.911 | R$ 4,25252 | R$ 2,81011 |

| 2020 | 258.178 | 444.000 | 702.178 | R$ 1,06571 | R$ 0,67387 |

| 2019 | 593.858 | 293.556 | 887.414 | R$ 1,34685 | R$ 0,44554 |

| 2018 | 592.000 | 1.477.999 | 2.069.999 | R$ 12,56672 | R$ 8,97276 |

| 2017 | - | 637.900 | 637.900 | R$ 3,87261 | R$ 3,87261 |

| 2016 | - | 110.000 | 110.000 | R$ 0,66780 | R$ 0,66780 |

| 2015 | - | 365.894 | 365.894 | R$ 2,26898 | R$ 2,26898 |

| 2014 | 230.000 | 195.000 | 425.000 | R$ 2,72631 | R$ 1,21971 |

| 2013 | - | - | - | R$ - | R$ - |

| 2012 | 128.107 | 348.570 | 476.677 | R$ 3,12247 | R$ 2,28330 |

| 2011 | 253.407 | 643.388 | 896.795 | R$ 5,90665 | R$ 4,23760 |

| 2010 | 188.564 | 578.232 | 766.796 | R$ 5,06851 | R$ 3,82337 |

| 2009 | 250.608 | 392.676 | 643.284 | R$ 4,29529 | R$ 2,62408 |

| 2008 | 279.018 | 436.611 | 715.629 | R$ 4,79374 | R$ 2,92469 |

| 2007 | 226.792 | 559.357 | 786.149 | R$ 5,26609 | R$ 3,74691 |

| 2006 | 90.000 | 97.300 | 187.300 | R$ 1,25465 | R$ 0,65177 |

| 2005 | 224.354 | - | 224.354 | R$ 1,50286 | R$ - |

| 2004 | 147.249 | - | 147.249 | R$ 0,98636 | R$ - |

| 2003 | 50.000 | 12.782 | 62.782 | R$ 0,42055 | R$ 0,08562 |

| 2002 | 86.353 | - | 86.353 | R$ 0,57844 | R$ - |

| Total | 5.363.445 | 8.444.796 | 13.808.242 | R$ 63,19939 | R$ 41,30871 |

|---|

| Fiscal Year (base) |

IOE (R$ thousand) |

Dividends (R$ thousand) |

Total (R$ thousand) |

Net Result Regulatory (R$ thousand) |

Payout Regulatory |

|---|---|---|---|---|---|

| 2024 | 1,555,515 | - | 1,555,515 | 2,076,571 | 75% |

| 2023 | 1,452,233 | - | 1,452,233 | 1,942,286 | 75% |

| 2022 | 700,000 | - | 700,000 | 936,887 | 75% |

| 2021 | 629,109 | 1,211,083 | 1,840,192 | 877,567 | 210% |

| 2020 | 586,180 | 1,084,449 | 1,670,629 | 2,002,390 | 83% |

| 2019 | 701,704 | 293,556 | 995,259 | 1,221,830 | 81% |

| 2018 | 592,000 | 1,393,306 | 1,985,306 | 1,276,311 | 156% |

| 2017 | - | 585,093 | 585,093 | 615,474 | 95% |

| 2016 | - | 247,500 | 247,500 | 228,785 | 108% |

| 2015 | - | 334,865 | 334,865 | 271,887 | 123% |

| 2014 | 30,000 | 196,029 | 226,029 | 248,140 | 91% |

| 2013 | 200,000 | 30,000 | 230,000 | - 145,400 | N/A |

| 2012 | 63,949 | 178,729 | 242,678 | 1,004,000 | 24% |

| 2011 | 188,846 | 503,136 | 691,982 | 805,700 | 86% |

| 2010 | 255,363 | 520,044 | 775,407 | 812,171 | 95% |

| 2009 | 312,528 | 532,567 | 845,095 | 861,975 | 98% |

| 2008 | 239,896 | 495,001 | 734,897 | 827,065 | 89% |

| 2007 | 238,737 | 668,759 | 907,495 | 855,483 | 106% |

| 2006 | 27,177 | 157,899 | 185,076 | 117,752 | 157% |

| 2005 | 239,354 | - | 239,354 | 468,277 | 51% |

| 2004 | 75,000 | - | 75,000 | 348,778 | 22% |

| 2003 | 147,249 | - | 147,249 | 222,376 | 66% |

| 2002 | 136,353 | 12,782 | 149,135 | 168,137 | 89% |

| Total | 9,312,894 | 8,444,809 | 16,817,703 | 18,044,442 | 93% |

|---|

Click here to download the spreadsheet

Annual Summary of Earnings Distribution (R$ million)

2 Distribution of dividends, based on the reserve constituted in the financial statements regarding the year of 2017.

3 Distribution of interim dividends on the constituted profit reserve.

Updated on December 19, 2025.